Estate Taxes And Inheritance Taxes In Europe Tax Foundation

Estate tax in Switzerland can apply if you buy a Swiss property so estate planning is vital Inheritance tax rules and what you pay can also vary depending on which Swiss canton you. Aside from Vaud no other canton applies inheritance and gift taxes to the children of the deceased which is a significant exception to the general rule that youll want to keep in mind. Open all Who has to pay inheritance tax Taxation of inheritances from abroad Further information and contacts A service of the Confederation cantons. Non-Resident Alien and Non-Citizen Services US Estate Tax and Residents of Switzerland Effective January 1 2018 the Tax Cuts and Jobs Act granted US. Switzerland is divided into 26 cantons with 26 different cantonal tax regimes Rates depend on the relationship with the deceased from 0 to 50..

Every owner of residential or commercial buildings in Switzerland is liable to the real estate tax However certain cantons have decided not to levy the tax. Whether you buy own or sell a house or apartment taxes have to be paid These taxes are levied in the place where the property is located Property gains tax on the profits from. Here we lay out the various Swiss taxes applicable to non-resident buyers and give some examples of the tax rates in the main cantons in which property is available for sale to. Due diligence costs for the purchase of real estate 11 Municipal search Cost Mapzoning plan EUR 10-EUR 70 VAT 77 12 Utility search each service Cost NA VAT NA 13 Land registry. Real estate usually involves high value assets In parallel there is an enormous variety of tax laws ordinances directives as well as published and non-public practices of the tax authorities in..

Elevated Gift Tax Exclusions Will Sunset after 2025 The 2017 Tax Cuts and Jobs Act TCJA nearly doubled the lifetime estate and gift tax exemption from 56 million to. In 2017 the Tax Cuts and Jobs Act TCJA doubled the existing estate and gift tax exemption amounts from 56 million per person or 1118 million per married couple to 1118. When the Trump Tax Act was enacted in 2017 estate planning attorneys warned their wealthy clients the approximately 11 million lifetime federal estate tax exemption was not. The estate tax exemption is set to drop back to 5 million on Jan 1 2026 what it was before. Federal estate tax rates max out at 40 for amounts higher than 1 million..

Estate tax in Switzerland can apply if you buy a Swiss property so estate planning is vital Inheritance tax rules and what you pay can also vary depending on which Swiss canton you. Aside from Vaud no other canton applies inheritance and gift taxes to the children of the deceased which is a significant exception to the general rule that youll want to keep in mind. Open all Who has to pay inheritance tax Taxation of inheritances from abroad Further information and contacts A service of the Confederation cantons. Non-Resident Alien and Non-Citizen Services US Estate Tax and Residents of Switzerland Effective January 1 2018 the Tax Cuts and Jobs Act granted US. Switzerland is divided into 26 cantons with 26 different cantonal tax regimes Rates depend on the relationship with the deceased from 0 to 50..

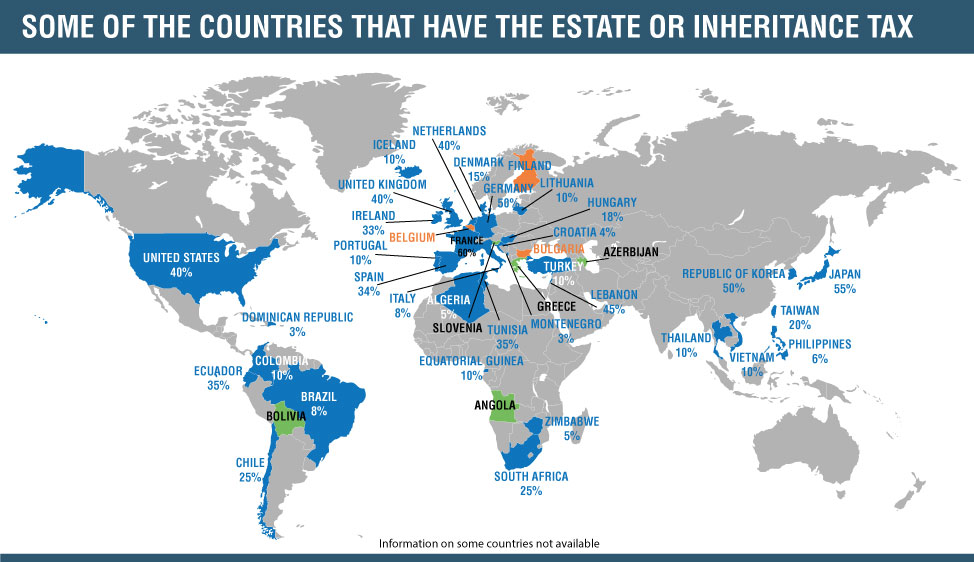

Countries With Or Without An Estate Or Inheritance Tax Family Enterprise Usa

Comments